This is a legal form that was released by the Texas Department of Motor Vehicles - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

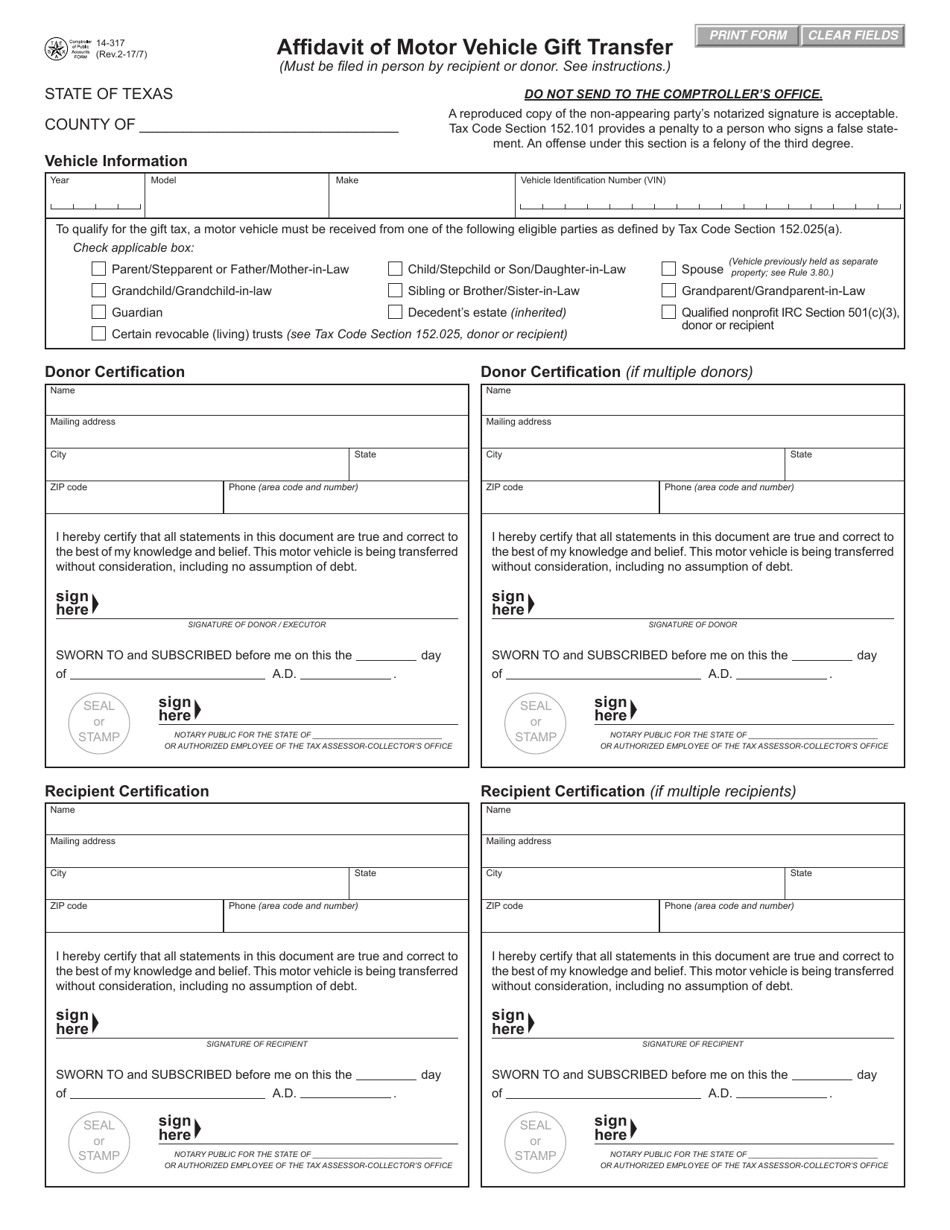

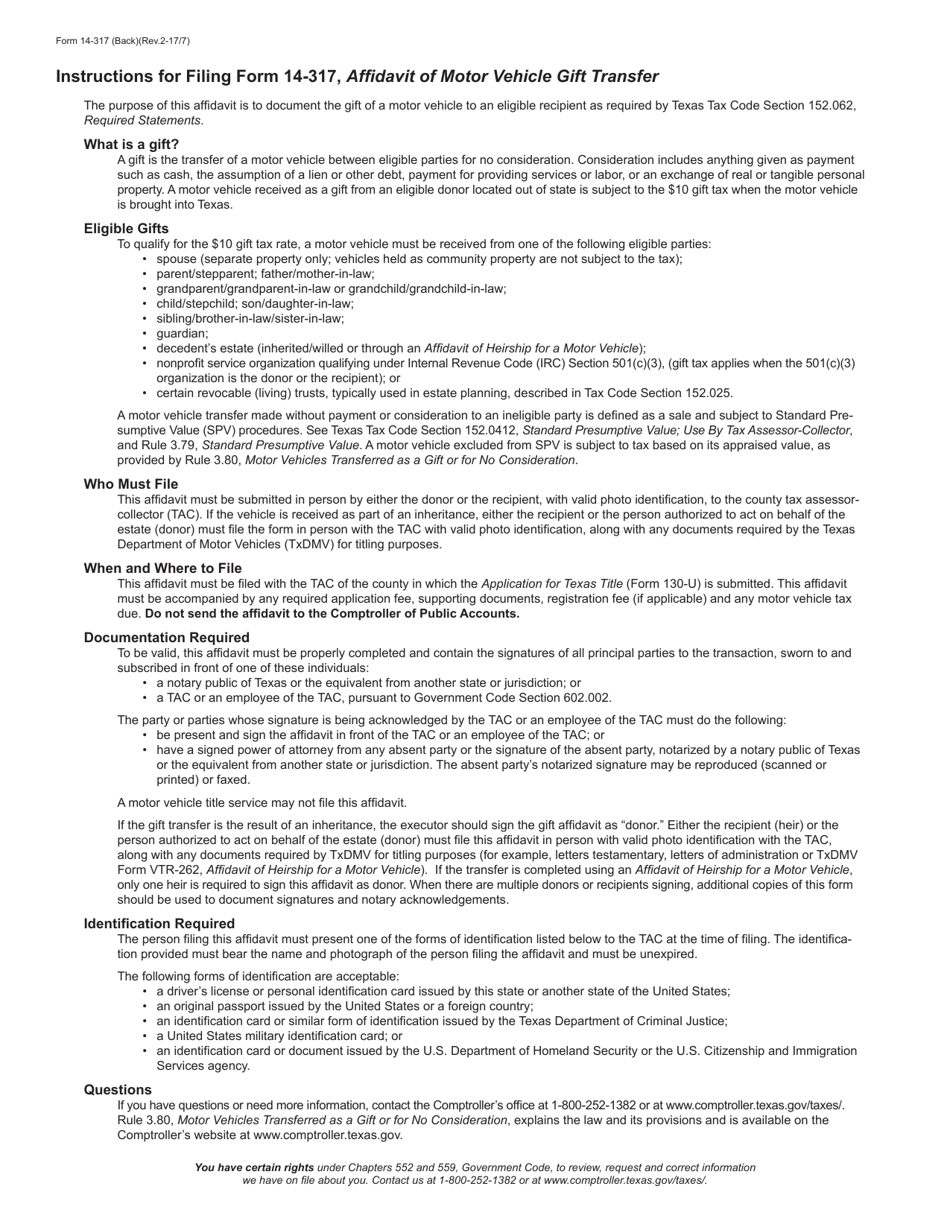

Q: What is Form 14-317?

A: Form 14-317 is the Affidavit of Motor Vehicle Gift Transfer in Texas.

Q: What is the purpose of Form 14-317?

A: The purpose of Form 14-317 is to transfer ownership of a motor vehicle as a gift.

Q: Who can use Form 14-317?

A: This form can be used by the person giving the vehicle as a gift and the person receiving the vehicle.

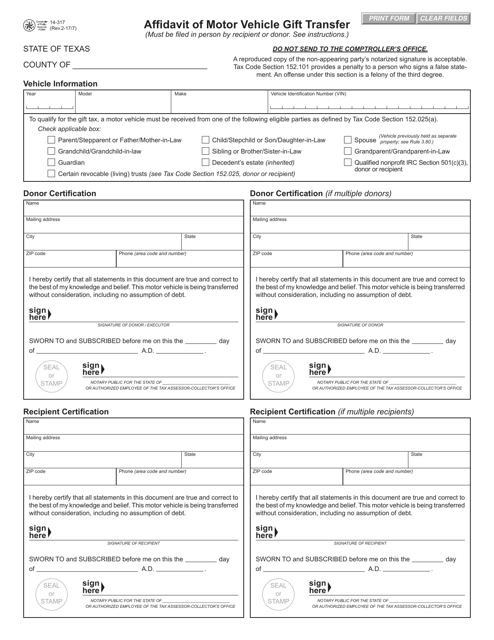

Q: What information is needed on Form 14-317?

A: The form requires information about the vehicle, the donor, and the recipient, as well as a statement of gift.

Q: Are there any fees associated with Form 14-317?

A: No, there are no fees for filing this form.

Q: What do I do after completing Form 14-317?

A: The completed form should be submitted to the Texas Department of Motor Vehicles or a local tax office.

Q: Is Form 14-317 applicable in other states?

A: No, Form 14-317 is specific to the state of Texas.

Q: Are there any restrictions on gift transfers with Form 14-317?

A: Yes, there are specific eligibility criteria for a motor vehicle to be considered a gift transfer.

Form Details:

Download a fillable version of Form 14-317 by clicking the link below or browse more documents and templates provided by the Texas Department of Motor Vehicles.

1

2

Vehicle Gift Transfer - Texas, Page 1" width="950" height="1230" />

Vehicle Gift Transfer - Texas, Page 1" width="950" height="1230" /> Vehicle Gift Transfer - Texas, Page 2" />

Vehicle Gift Transfer - Texas, Page 2" />Gift Transfer Vehicle Transfer Form Texas Department of Motor Vehicles Motor Vehicle Texas Legal Forms United States Legal Forms

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.